A Comprehensive Guide to Oil and Gas Risk Management: What are Effective Risk Mitigation Strategies and How Simulation Used for It

With its global significance and intricate operations, the oil and gas industry faces a plethora of risks that can affect everything from production and exploration to market volatility and geopolitical events. A solid risk management framework is required to successfully navigate these challenges. In this article, we delve into the world of oil and gas risk management, investigating the industry’s key challenges, the strategies used to mitigate potential risks in the petroleum industry, and how simulation technology is used in oil and gas risk management.

Understanding Oil and Gas Risk Management

Key Risks Faced by the Oil and Gas Industry

1.Price Volatility

The inherent volatility of commodity prices is perhaps the most significant risk in the oil and gas industry. Oil price fluctuations can have a significant impact on revenues, profitability, and investment decisions. Risk management strategies often involve the use of financial instruments, such as hedging contracts, to mitigate the effects of price volatility and provide a level of predictability in cash flows.

2. Geopolitical Uncertainty

Because the oil and gas industry operates on a global scale, it is vulnerable to geopolitical tensions and uncertainties. Political unrest, sanctions, and regional conflicts can disrupt supply chains, halt exploration, and create unexpected operational challenges. In this context, rigorous geopolitical risk analysis and strategic diversification of assets and operations are critical components of risk management.

3. Regulatory Compliance

The oil and gas industry’s evolving and stringent regulatory frameworks necessitate a proactive approach to compliance. Noncompliance can result in significant financial penalties, operational disruptions, and reputational damage to the industry. Staying up to date on regulatory changes, implementing effective compliance programs, and conducting regular audits to ensure standard adherence are all examples of strong risk management practices.

4. Operational Risks

The complex nature of oil and gas operations introduces a range of risks, including equipment failures, accidents, and natural disasters. Comprehensive risk management strategies involve preventive measures, such as regular maintenance and safety protocols, as well as contingency plans to respond swiftly and effectively in the event of an operational incident.

Effective Risk Mitigation Strategies in the Oil and Gas Industry

1. Diversification of Assets

To mitigate risks associated with geopolitical instability and market volatility, companies often diversify their portfolios. This may involve having operations in multiple regions, exploring various types of oil and gas resources, and engaging in both upstream and downstream activities. Diversification helps create a buffer against the impact of localized disruptions.

2. Financial Hedging

Financial instruments, such as futures and options contracts, play a crucial role in hedging against price fluctuations. By locking in prices for future production or purchases, companies can mitigate the impact of volatile commodity markets and ensure a more predictable revenue stream.

3. Strategic Alliances and Partnerships

Risk-sharing mechanisms can be provided by collaborative efforts and strategic alliances with other industry players. Companies can improve their resilience in the face of challenges by sharing resources, knowledge, and expertise, particularly in exploration and development projects.

4. Technology and Data Analytics

Companies can improve their risk assessment capabilities by embracing advanced technologies such as data analytics, artificial intelligence, and machine learning. Predictive analytics can help identify potential problems before they become major problems, allowing for proactive risk management and preventive measures.

5. Scenario Planning and Contingency Preparedness

Companies can develop robust contingency plans through rigorous scenario planning that takes into account a wide range of potential risks and outcomes. These plans detail responses to various scenarios, ensuring a quick and effective response in the event of unexpected challenges.

Simulation Technology Used in the Oil and Gas Risk Management

By providing a dynamic and interactive platform for modeling, assessing, and mitigating potential risks across various aspects of the industry, simulation technology plays a critical role in oil and gas risk management.

1. Reservoir and Production Simulation

Objective: Assessing risks associated with reservoir behavior and production dynamics.

How it’s used: Simulation models aid in the prediction of reservoir performance, the evaluation of various production strategies, and the assessment of the impact of uncertainties such as reservoir heterogeneity or fluid composition. Operators can identify potential risks to production rates and optimize reservoir management strategies by simulating various scenarios.

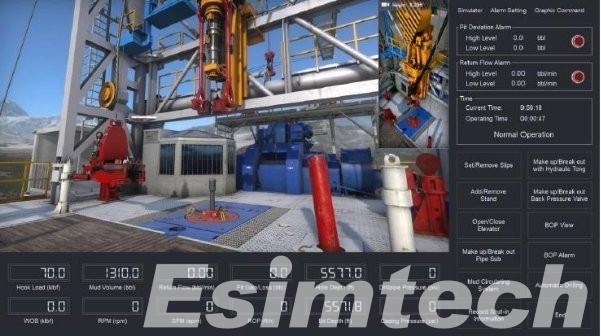

2. Drilling and Wellbore Simulation

Objective: Identifying and mitigating risks related to drilling operations.

How it’s used: Drilling simulators enable operators to practice drilling tasks such as complex wellbore trajectories and potential hazards. The use of simulation technology allows for the evaluation of risks associated with various drilling parameters, well designs, and geological conditions. This aids in the optimization of drilling plans and the enhancement of safety protocols.

3. Emergency Response Planning

Objective: Improving preparedness and response strategies for emergency scenarios.

How it’s used: Emergency training simulation system is employed to model emergency scenarios, such as well blowouts, fires, or gas leaks. This allows for realistic training of response teams in a virtual environment, helping them understand the dynamics of emergency situations and practice effective decision-making. It also aids in refining emergency response plans to address potential risks.

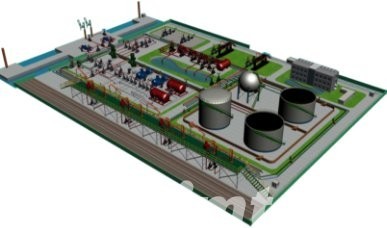

4. Supply Chain and Logistics Simulation

Objective: Assessing and managing risks in the oil and gas supply chain.

How it’s used: oil and gas transportation simulation tools model the entire supply chain, including inventory management and distribution. By simulating different scenarios, such as supply disruptions, logistical challenges, or changes in market demand, companies can identify vulnerabilities and develop risk mitigation strategies to ensure a resilient and efficient supply chain.

5. Market and Price Risk Simulation

Objective: Evaluating risks associated with market volatility and commodity price fluctuations.

How it’s used: To simulate various market scenarios, simulation models integrate market data, geopolitical factors, and demand trends. This aids in determining how price fluctuations affect revenue, profit margins, and investment decisions. Companies can develop strategies to mitigate price-related risks by understanding market dynamics.

6. Regulatory Compliance Simulation

Objective: Ensuring compliance with evolving and stringent regulatory frameworks.

How it’s used: Simulation is employed to model the impact of regulatory changes on operations and assess compliance risks. By simulating different compliance scenarios, companies can proactively adapt their processes to meet regulatory requirements. This reduces the risk of non-compliance, potential legal issues, and associated financial penalties.

7. Asset Integrity and Reliability Simulation

Objective: Managing risks associated with equipment integrity and reliability.

How it’s used: Simulation technologies model the performance and degradation of equipment over time. By simulating various maintenance strategies, companies can assess the risks associated with equipment failures, plan for preventive maintenance, and optimize asset performance. This contributes to minimizing operational disruptions and associated risks.

Conclusion

Oil and gas risk management is a dynamic and essential component of the industry’s operational strategy. Companies can navigate the complexities of the industry with greater resilience and agility by understanding the multifaceted nature of risks and implementing comprehensive risk management frameworks. Oil and gas simulation technology provides a comprehensive and proactive approach to identifying, assessing, and mitigating risks. Industry professionals can make more informed decisions, improve safety measures, and improve overall operational resilience in the face of an ever-changing and challenging environment by simulating various scenarios.