Why Deepwater and Ultra Deepwater Drilling Are Going Mainstream?

Due to the global oil industry’s firm demand and the shallow-water resources still being depleted, deep-water and ultra deepwater drilling are rapidly expanding into key segments of the Offshore Development Strategy. With more favourable economic returns, stronger safety records, and major discoveries clustered within the deep and ultra-deep-water basin, long-cycle operators now view these projects as capable of providing steady production and beneficial financial returns. The next sections discuss why these offshore drilling segments are becoming more popular and what the driving forces are behind the operators prioritising these segments in their capital spending budgets.

The Global Energy Drivers Pushing Deepwater Drilling Forward

Deepwater drilling is gaining momentum as companies consider long-term supply options and the global economy continues to evolve. New factors are making this market even more significant:

1. Mature Basins and the Increasing Need for Replacements:

Production in older basins like North America, onshore, the North Sea, and Southeast Asia continues to decline, even with new and improved efforts. As the rate of decline exceeds the number of new oil discoveries, companies are turning to deepwater for large, untapped reserves and more productive wells.

2. Demand and Supply Stability:

Even with increased efficiency and the rise of renewables, the demand for oil remains stable, if not increasing. Countries prioritising security of supply are exploring deepwater options as well as onshore. With a prolonged plateau phase, deepwater fields are more dependable.

- Less Risk of Geopolitical Instability

Offshore deepwater basins are often surrounded by stable political conditions, unlike some of the turbulent onshore areas. Such a calm environment makes it easy to invest billions of pounds into the projects that will need to be built over several years.

- More Cost Efficiency Improvements

The continuous efforts to improve cost efficiency have yielded standard well designs, streamlined supply chains, and more efficient rigs, and as a consequence, deepwater break-even prices have drastically decreased. Competitively attainable cost ranges could be seen in many new projects, making deepwater drilling a strategically and economically reasonable choice for diversified portfolios.

The combination of all these variables is driving deepwater drilling to be a reliable resource for new supply and changing the priorities of investing in offshore.

Why Ultra Deepwater Drilling Offers Higher Return Potential for Operators

There are three key elements to consider:

Availability of Quality and Productive Reservoirs

Ultra deepwater tracts are characterised by large and well-pressured reservoirs of consistent fluid properties and great rock quality. These properties allow for quicker and better cash flows for investors as there’s high initial production and even better, strong recovery is maintained over time. Compared to other onshore or shallow-water environments, most ultra-deep plays have rock and reservoir quality that is vastly superior.

Long, Stable Production Profiles That Improve Project Economics

Ultra-deepwater fields naturally decline more slowly and have longer plateau phases compared to shale and other short-cycle resources. Because of this, annual output becomes more stable, leading to improved capital efficiency and less volatility. This is especially important when it comes to more predictable return profiles. For oil operators hoping to acquire more ultra-deepwater drilling opportunities, this stability makes it clear why ultra-deepwater fields are more sought after than shallower fields.

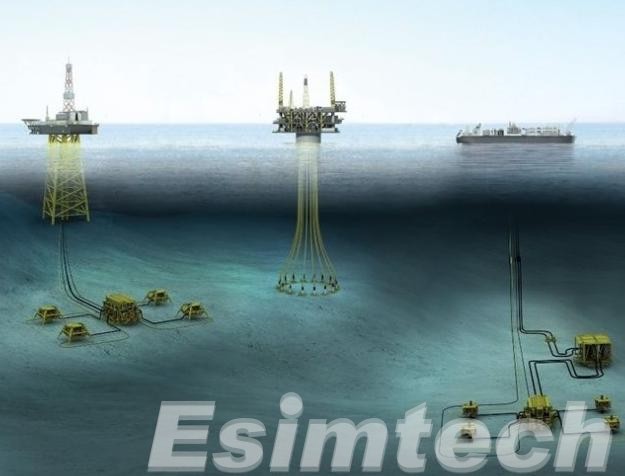

Faster Monetization Through Subsea Tiebacks and Existing Infrastructure

With advances in subsea infrastructures, it is now easier for smaller and more remote oil fields to be connected to nearby FPSOs. This greatly reduces upfront capital requirements and allows for quicker access to oil. Because less capital is needed and access to oil is quicker, subsea tiebacks automatically improve project net present value. This is why flexible subsea infrastructures improve profitability margins.

Technology Breakthroughs Making Deepwater Drilling Safer and More Efficient

Ultradeep water and deep water drilling have entered a new stage of safety and operational efficiency. New technologies are lowering operational risk and improving the economics of the projects and are making deep water developments more attractive from an operational perspective.

Next-Generation Drilling Rigs

Incrased operational capability of modern drillships and semi-submersible rigs:

- Advanced dynamic positioning systems that allow for stable operational control during extreme conditions.

- Automated pipe handling with capabilities to control and perform HPHT (high pressure/high temperature) wells.

- Upgraded reinforced risers and subsea connectors that extend operational windows.

Improvements of this nature allow deep water crews to be confident and operate with limited downtime from the weather and/or other mechanical constraints.

Real-Time Monitoring and Predictive Analytics

By combining digital technology with downhole sensors, logging mud, and subsea equipment, well conditions can be monitored in real-time. This enables operators to:

- Detect early signs of pressure anomalies or equipment fatigue

- Adjust drilling parameters in real-time

- Reduce non-productive time (NPT) to gain control of the well

This forward-thinking tactic of risk minimisation fosters reliable streamlining of deepwater operations.

Advanced Subsea and Well-Control Technologies

Subsea technology has improved with:

- Automated and redundant BOPs.

- Condition Based Monitoring for subsea trees, manifolds, and control pods.

- Enhanced ease and improved reliability of international regulation compliance.

Collectively, these developments make deepwater drilling safer, more predictable, and cost-efficient, which is why operators are heavily investing in deepwater and ultra-deepwater projects.

Simulation and Training

Offshore drilling simulators have become a critical tool for deepwater operations. They allow crews to rehearse complex drilling scenarios, practice emergency responses, and optimize decision-making without risking actual wells. Simulation reduces human error and ensures that operators are prepared for both routine and extreme conditions.

Benefits in Deepwater Drilling and Ultra Deepwater Drilling Operations

The advantages of high-quality reservoirs become the least of the benefits to operators regarding deepwater drilling and ultra deepwater drilling. The most important advantages are as follows.

- Higher output per well: With deeper and ultra deeper water wells, operators experience high initial flow rates. This depth of water gives faster payback and overall project cash flow as there are fewer wells needing construction and an overall improved ability to manage the portfolio.

- Stability of assets in the long run: With deep water fields, there is an overall ability to have stable production over 15-30 years. The plateau phases exhibit less volatility in the production output. This efficiency provides an overall reliability to manage the supply and the overall capital in the long term.

- Greater Safety and Control of Operations: Recent advancements in blowout preventers and automated systems, alongside the ability to monitor in real-time, continue to make deepwater drilling operations not just safer, but also more predictable. This reduces the operational risk and preserves more of the project’s economic value while also protecting the personnel involved.

- Efficient Costs and More Accurate Predictability: Well designs that have been standardised, subsea tie-backs, and better-organised logistics for unplanned work of the operational supply chain all enable better prediction of the CAPEX and OPEX, which better determines the overall operational costs. Efficient scheduling rig supply chains and sub logistics also reduce unproductive time.

- More Options for New Development and Growth: Modular infrastructure and subsea tie-backs streamline the works needed to access smaller or more isolated treasure troves of fossil fuel. This opens the door to more incremental expansions and more rapidly taking advantage of quick market changes. All of which combine to improve the economic value of ultra deepwater projects.

Conclusion

Deep and ultra-deep water drilling, no longer niche or high risk, have become essential functions of offshore development. Rapidly changing economics, better technology, and stable long-cycle supply are making these sectors more important than any other in the upcoming energy cycle. Investors that focus on developing their capacity, verticals, and technology are more strategic for long-term gain when offshore development speed increases.